House next year, Marriage this year

A Guide for Aspiring Couples Considering the Financial Realities of Weddings and Homeownership. So, lets discuss Wedding vs. Homeownership UK

In a world where dreams of homeownership often clash with visions of lavish weddings, couples in the UK are finding themselves at a crossroads.

So, here’s a question for all the couples who love those big, fancy weddings: should you focus on buying a house next year, or should you tie the knot this year?

In this blog, we’ll talk about why having an affordable wedding now might be a smart move, especially with all the rising costs. Let’s dive in Wedding vs. Homeownership UK.

The Changing World of Owning a Home

Owning a house is a big dream for lots of people, but things have been getting more complicated in the UK lately. Here’s why:

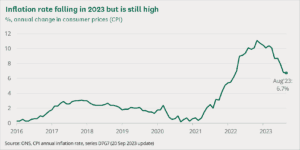

1. Dealing with Rising Prices

The UK has seen prices go up a lot, which makes everything more expensive. Everyday things like food and bills cost more, and saving up to buy a house becomes harder when you’re spending more on these basics.

2. The Mortgage Rate Rollercoaster

The government’s decision to increase mortgage rates has made borrowing money for a home more expensive. With higher mortgage rates, monthly payments become heftier, adding to the overall cost of your property purchase. This has prompted many prospective homebuyers to reconsider their financial strategies.

The Wedding Dilemma: Why Choose This Year?

Despite the allure of homeownership, there are compelling reasons to consider putting off that big property purchase and focusing on your wedding this year:

1. The Allure of Grand Sapphire Banquets

For couples seeking a grand and elegant wedding venue, Grand Sapphire Banquets is a name that beckons. Known for its opulent ambiance and exceptional service, it offers an enchanting setting for your special day. Opting for a weekday wedding at such a venue can unlock attractive packages, allowing you to indulge in luxury without straining your budget.

2. Celebrating Love Without Limits

Love doesn’t wait for a perfect time or date. Celebrating your love and commitment to each other this year enables you to create cherished memories with family and friends. It’s a chance to share your happiness and joy, which are priceless experiences.

3. Time to Build a Strong Financial Foundation

Delaying your house purchase can provide you with the time needed to strengthen your financial position. You can save more money, work on improving your credit score, and perhaps secure a better mortgage rate. Waiting a bit longer can lead to greater financial stability when you do decide to buy a house.

Conclusion: Your Unique Love Story, Your Financial Adventure

In this tale of love and owning a home, remember that life is full of surprises and twists. Whether you decide to celebrate your love with a grand wedding this year or patiently save for your dream home, the path you choose is yours alone. Life is an exciting journey, and each decision you make adds a new chapter to your story. So, enjoy the ride, make smart choices, and stay tuned for the next thrilling chapter in the story of love and property in the ever-changing world of UK finances!